Navigating the EU's Carbon Border Adjustment Mechanism (CBAM)

As of January 1, 2026, the EU's Carbon Border Adjustment Mechanism (CBAM) - a tariff on carbon-intensive goods entering the EU - is in force. We speak to Enco Insights’ Senior Carbon Markets Advisor, Peter Fegelman, about the rules and impacts for energy and commodities organisations.

Enco Insights, London - 16 December 2026

Issues explored in this briefing:

How does CBAM work in practice?

What is the timeline for its implementation, including the transitional phase?

How can companies turn CBAM compliance into a competitive advantage?

How should businesses prepare for potential volatility in carbon prices under CBAM?

Understanding CBAM

Enco Insights: Enco Insights: What is the Carbon Border Adjustment Mechanism (CBAM)?

Peter Fegelman: Legislated as part of the European Green Deal in May 2023, CBAM is essentially an import tariff on carbon-intensive goods. The initial scope covers hard-to-abate products with high emission intensity in sectors which are significantly exposed to international trade: iron and steel, aluminium, cement, fertiliser, electricity and hydrogen. It also covers certain ‘precursor materials’ used to manufacture these goods.

Enco: What is the strategic intent behind CBAM, and how does it complement the EU ETS?

Peter: CBAM is intended to ensure that imports for the covered products bear the same carbon cost as EU producers, creating a level playing field in the EU market.

It is also designed to reduce industrial “leakage” which undermines the environmental integrity of an ETS. When an emissions trading system (ETS), such as the EU ETS, imposes carbon costs on domestic industry, firms may shift production to countries with weaker environmental policies. This dynamic can offset the global emissions reductions in the EU. It may also allow cheaper and higher carbon-intensive imports to gain EU market share.

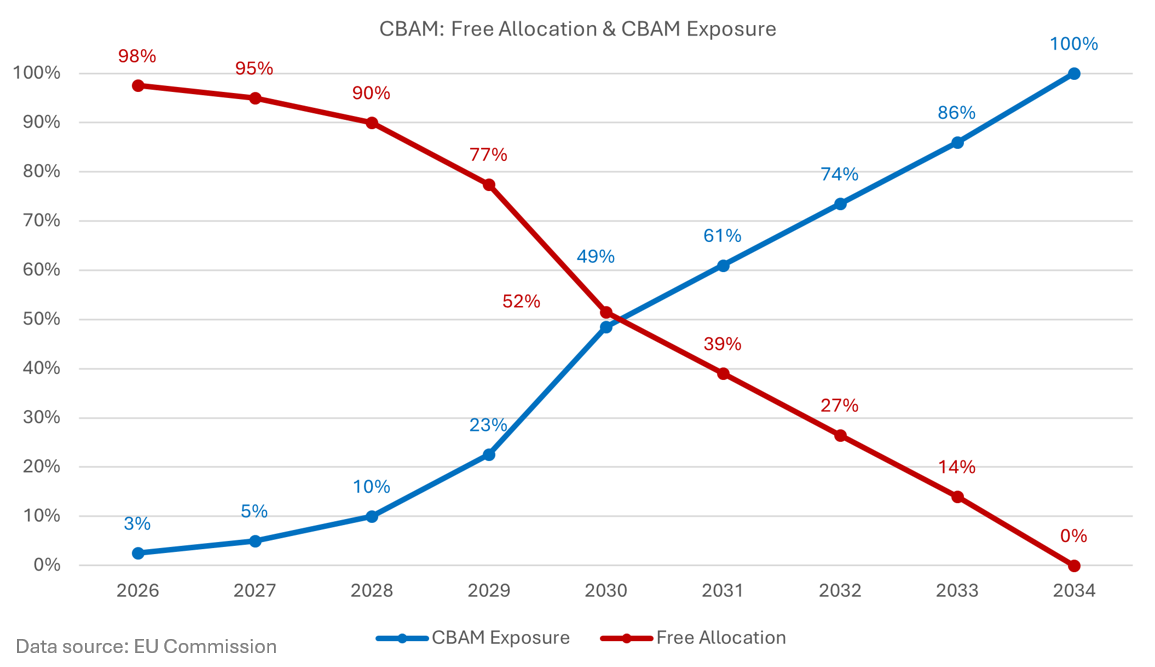

Historically, the EU addressed leakage by granting free allowances to domestic industry. While this reduced compliance costs, it also weakened incentives to decarbonise. CBAM therefore replaces free allocations with carbon-adjusted import tariffs, phasing the application of both on the same timeline, as reflected in the following graph.

CBAM replaces free allocations with carbon-adjusted import tariffs, phasing the application on the same timeline.

Peter Fegelman is an Enco Expert Advisor specialising in carbon markets, with expertise across voluntary and compliance markets.

Currently, a founding partner at SusCap Advisors, Peter was previously Head of Carbon Market Analytics at MSCI Carbon Markets and Chief Investment Officer at Bricklayers Asset Management, which invested in the carbon markets for several pension funds. He has also held senior finance and investment roles at organisations including Citigroup, Lehman Brothers, and several prominent hedge funds.

“A strong CBAM capability can reduce costs, regulatory risks and position the company as a preferred supplier to its customers, creating a competitive advantage over companies who are less successful in complying with CBAM.”

Enco: How does CBAM work in practice, and what is the timeline for its implementation, including the transitional phase?

Peter: The CBAM tariff is applied to embedded emissions, which include both direct emissions resulting from the production process of covered goods (i.e., fuel consumption) and, in certain cases, indirect emissions from the production of electricity consumed during the production process. It is being implemented in two phases:

1. ‘Transitional phase’ - From October 1, 2023, through December 31, 2025. Over this period, EU importers were required to report embedded emissions quarterly, but they did not have to pay the CBAM tariff.

2. ‘Definitive phase’ - Starting January 1, 2026. In this phase, importers become financially liable for the cost of CBAM Certificates, although the certificates will not be available to purchase until February 2027.

Strategic & Market Impact

Enco: How might CBAM influence carbon pricing policies in other regions and countries?

Peter: CBAM is intended to create regulatory equivalence between the EU ETS and its trading partners. Importers and the related underlying exporters in the relevant countries can reduce the cost of CBAM certificates by the cost of carbon taxes or carbon allowances in their home country.

While the eventual total cost of the carbon allowance for the imported good does not change (as it’s either fully captured by the CBAM certificate or split between the certificate and the exporting country’s carbon allowance or tax), there is a big difference for the exporting country’s government. Instead of the carbon allowance revenue completely flowing into the pocket of the EU, in the form of the CBAM certificate, some or potentially all revenue instead accrues to the exporting country’s coffers. The exporting countries may thus be highly incentivised to implement their own carbon pricing regimes.

Enco: Are there examples of CBAM influencing change by other nations and industries?

Peter: CBAM has, in fact, already become a driving force for many countries to develop domestic ETS and enhance their own emissions monitoring and reporting. For example:

South Korea - Has a domestic ETS. It has been ramping up efforts to help domestic SMEs meet emission reporting and verification requirements of CBAM.

Turkey - Its decision to establish an ETS was reported to be triggered by CBAM.

India - Significant exposure to the EU by its steel and aluminium exporters. It is implementing a national ETS to maintain competitiveness, especially given its dependence on coal, and to avoid losing tax revenues to the EU.

China - Has announced several policy initiatives in the last two years to enhance the scope of its domestic ETS to better measure the carbon content of its products. It has also accelerated the extension of its ETS to the cement, iron and steel sectors (perhaps no coincidence with the first year of CBAM looming).

CBAM could influence trade flows by making energy and emissions efficiency a greater factor in competitiveness.

Enco: How might CBAM reshape global trade patterns and supply chains over the next decade?

Peter: The EU is the second largest importer in the world following the United States, so CBAM has the potential to significantly influence global trade flows by making energy and emissions efficiency a critical driver of competitiveness. Given this factor and the EU’s lead in implementing a cross-border adjustment mechanism, the prospective globalisation of carbon as a cost factor may well follow EU standards for measuring carbon emissions and set the EUA as a price benchmark.

Many countries will likely raise their energy efficiency standards as they seek to remain competitive on a global basis. CBAM may also distort trade flows. For example, companies with less carbon-intensive production may export these products to the EU, while diverting more carbon-intensive products to other countries with less stringent environmental policies or keeping them for domestic consumption.

Enco: Which sectors and products will be most affected by CBAM in its initial and later phases?

Peter: The initial set of goods covered by CBAM are in hard-to-abate industrial sectors with high emission intensity, including iron and steel, aluminium, cement, fertiliser, electricity and hydrogen. The EU intends to broaden the coverage to all goods covered by the EU ETS by 2030. Future coverage will likely be determined by emissions intensity, EU trade exposure, leakage risk and data availability. Glass and ceramics, plastics and polymers, pulp and paper and other carbon intensive products are likely to be affected next.

The effects of CBAM may be significant for any sector which not only produces the covered products but also utilises them as an intermediate good. For example, Wood Mackenzie estimates that by the end of the definitive period, CBAM will increase the cost of delivered steel to the EU from India by 56% and China by 49%.

“CBAM has, in fact, already become a driving force for many countries to develop domestic ETS and enhance their own emission monitoring and reporting.”

Decarbonisation & Compliance

Enco: What are the biggest risks for companies that fail to adapt to CBAM requirements?

Peter: As CBAM tariffs become a component of the landed cost of goods, companies that fail to robustly evaluate carbon intensity across their supply chains may face higher costs and supply-chain bottlenecks, resulting in reduced competitiveness compared with importers that proactively secure suppliers with reliable carbon data. The key risks fall into the following main categories:

Legal and financial liability: EU importers are legally responsible for CBAM compliance, even though emissions data comes from foreign suppliers.

Data quality and availability risks: Inconsistent supplier data standards can lead to errors, delays, or incomplete emissions reporting.

High compliance complexity and cost: CBAM requires EU ETS-level monitoring, calculation, reporting, and third-party verification.

Penalty exposure: Late or inaccurate reporting can result in fines between €50 to €100 per ton, which may be increased significantly under certain circumstances.

Market access risk: Persistent failure to report accurate emissions and satisfy CBAM certificate obligations may restrict or block access to the EU market.

Higher carbon costs from default values: Reliance on conservative default emissions values instead of actual values calculated for an importer’s supply chain will result in significant increases in CBAM certificate costs.

Reduced competitiveness: Higher landed costs and supply-chain bottlenecks may disadvantage companies versus better-prepared competitors.

Supply-chain bottlenecks could impact companies that are under-prepared for the legislation.

Enco: How can companies turn CBAM compliance into a competitive advantage?

Peter: A strong CBAM capability can reduce costs, regulatory risks and position the company as a preferred supplier to its customers, creating a competitive advantage over companies who are less successful in complying with CBAM. This can be achieved in the following ways:

Reduced costs: Firms that build robust emission-measurement systems across their supply chains will be able to utilise actual verified emissions data, avoiding conservative and very punitive default values resulting in lower CBAM certificate costs, allowing them to improve price competitiveness in the EU market. Enhanced visibility over their carbon footprint may also help them identify cost-effective abatement opportunities.

Commercial advantage: EU regulatory reporting rules, particularly the Corporate Sustainability Reporting directive (CSRD) and the related European Sustainability Reporting Standards (ESRS), require EU buyers to prioritise suppliers that can provide reliable embedded emissions data. Such suppliers offer lower regulatory risks, amplifying the commercial advantage for companies that invest in rigorous CBAM emissions measurement capabilities.

Enco: What technological or operational investments are critical for CBAM readiness (e.g., digital reporting tools, supplier engagement)?

Peter: Companies need reliable systems to collect, calculate and store embedded-emissions data at the product and supplier level. This includes digital reporting tools aligned with CBAM/ETS methodologies, structured data-exchange protocols with suppliers, and internal controls to ensure data accuracy ahead of third-party verification.

Strengthening supplier engagement and establishing clear reporting workflows are essential so that required emissions data is delivered consistently and on time.

“Companies that fail to robustly evaluate carbon intensity across their supply chains may face higher costs and supply-chain bottlenecks, resulting in reduced competitiveness.”

Future Outlook

Enco: Do you expect CBAM to expand to downstream products beyond the current scope?

Peter: It is reasonable to expect CBAM to expand to downstream products over time. In fact, the EU in late December announced a proposal to expand CBAM’s scope in 2028 to include downstream products with significant steel and aluminium content. As free allocations are increasingly eliminated and EU producers in downstream manufacturing sectors (e.g., machinery, vehicles, fabricated metals, etc) face rising carbon costs under the EU ETS, the pressure to extend CBAM to imported competitors will increase.

If the EU does not eventually include downstream goods, carbon leakage may simply move from primary metals to finished products, again undermining both industrial competitiveness and climate objectives.

Enco How should businesses prepare for potential volatility in carbon prices under CBAM?

Peter: CBAM certificates will be priced off weekly averages of EUA auctions, allowing EUA futures to be used as a proxy hedging instrument. Price differences between futures and auction prices are typically minimal.

As certificates will not be available until early 2027, companies can hedge their near-term CBAM costs through EUA futures, directly or via OTC transactions. With liquid contracts across multiple maturities, firms can also hedge future exposures several years ahead. Expectations of a tightening EUA market point to rising prices, increasing the importance of hedging as free allocations decline.

Disclaimer: This material is for informational purposes only. It does not constitute legal, regulatory, tax, accounting or investment advice, nor should it be relied upon as such. The information reflects understanding of CBAM legislation and related EU regulatory frameworks at the time of writing and may change without notice. No representation or warranty, express or implied, is made regarding the accuracy or completeness of the information contained herein. Any reliance placed on this material is at the reader’s own risk - Peter Fegelman.

How can Enco Advisors support you?

We connect seasoned industry practitioners with senior executives and leaders from across the energy and commodities markets globally. Engagements can range from a one-day session to a longer-term interim position.